You are here:iutback shop > trade

Can the Government Tax Bitcoin?

iutback shop2024-09-20 23:22:27【trade】1people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent years, Bitcoin has emerged as a revolutionary digital currency that has captured the atten airdrop,dex,cex,markets,trade value chart,buy,In recent years, Bitcoin has emerged as a revolutionary digital currency that has captured the atten

In recent years, Bitcoin has emerged as a revolutionary digital currency that has captured the attention of investors and governments alike. As the popularity of Bitcoin continues to soar, one question that has been on many people's minds is: Can the government tax Bitcoin? This article aims to explore this question and shed light on the complexities surrounding the taxation of Bitcoin.

Firstly, it is important to understand that Bitcoin is a decentralized digital currency that operates independently of any central authority. Unlike traditional fiat currencies, Bitcoin is not controlled by any government or financial institution. This decentralized nature raises the question of whether governments have the authority to tax Bitcoin transactions.

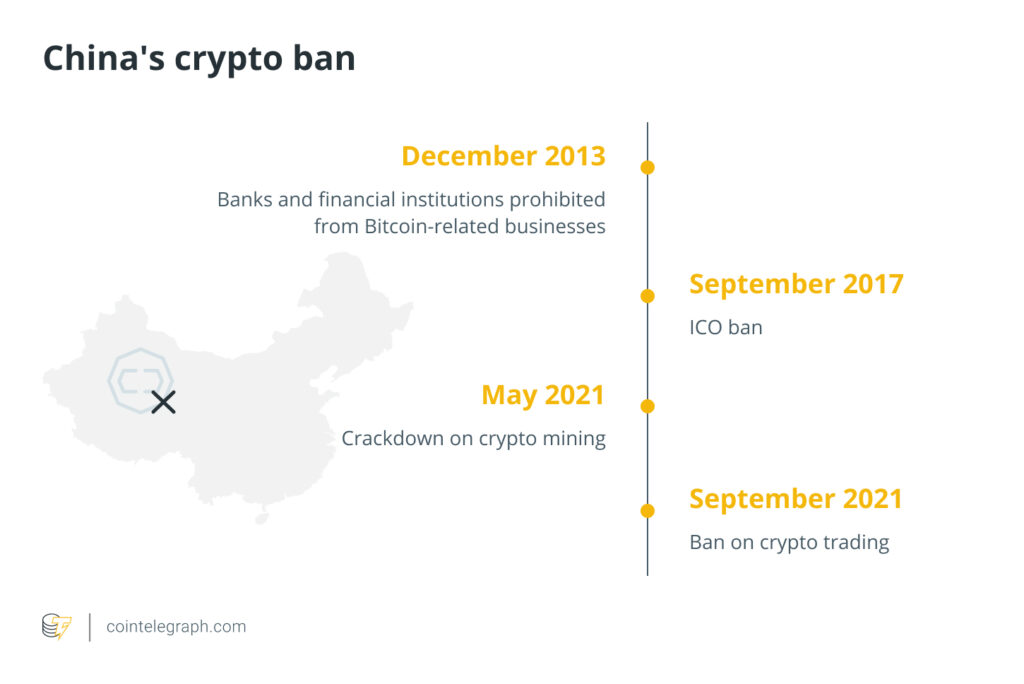

The answer to this question is not straightforward. The legality of taxing Bitcoin varies from country to country, and even within countries, the tax treatment of Bitcoin can differ depending on the specific transaction or use case. In some countries, Bitcoin is considered a digital asset, while in others, it is classified as a currency or a commodity.

In countries where Bitcoin is considered a digital asset, governments can tax it in several ways. One common approach is to treat Bitcoin as property and apply capital gains tax on any profits made from selling Bitcoin. This means that if an individual buys Bitcoin for $10,000 and later sells it for $20,000, they would be taxed on the $10,000 profit. This approach is similar to the taxation of stocks or real estate.

Another method used by governments is to tax Bitcoin transactions as income. In this case, individuals would be required to report their Bitcoin income and pay taxes on it, just like they would with any other form of income. This approach is often used when Bitcoin is used to purchase goods or services, or when it is earned through mining or other activities.

However, the taxation of Bitcoin can become more complex when considering cross-border transactions. Since Bitcoin is a global currency, transactions can easily cross international borders. This presents challenges for governments in terms of enforcing tax regulations and ensuring that individuals and businesses pay the appropriate taxes.

One of the main reasons why taxing Bitcoin is challenging is the difficulty of tracking and tracing transactions. Unlike traditional banking systems, Bitcoin transactions are recorded on a public ledger called the blockchain. While this ledger provides transparency, it also makes it difficult for governments to monitor and tax Bitcoin transactions without the cooperation of the network participants.

Despite these challenges, many governments have taken steps to regulate and tax Bitcoin. For example, the United States Internal Revenue Service (IRS) has classified Bitcoin as property and requires individuals to report their Bitcoin transactions on their tax returns. Similarly, the European Union has proposed a directive that would require member states to tax Bitcoin transactions.

In conclusion, the question of whether the government can tax Bitcoin is a complex issue that depends on the specific country and the nature of the transaction. While some governments have implemented regulations and tax measures, others are still grappling with how to address the challenges posed by this decentralized digital currency. As Bitcoin continues to gain popularity, it is likely that governments will continue to explore and adapt their tax policies to keep pace with this rapidly evolving landscape.

This article address:https://www.iutback.com/crypto/25e35299622.html

Like!(7759)

Related Posts

- Unlocking the Future of Cryptocurrency: The Bitcoin Mining Robot App Revolution

- Title: How to Withdraw Crypto to Cash Using Binance

- What Exactly Is Mining for Bitcoin?

- How to Set Up Bitcoin on Cash App: A Step-by-Step Guide

- Title: Enhancing Your Crypto Experience: The Bitcoin INR Price Widget

- Binance Can't Trade Terms of Use: What You Need to Know

- Bitcoin Cash Value 2030: A Glimpse into the Future

- Title: How to Withdraw Crypto to Cash Using Binance

- When Does Bitcoin Stop Mining?

- How to Add Money to Binance App: A Step-by-Step Guide

Popular

Recent

Binance vs Coinbase Pro Reddit: A Comprehensive Comparison

How to Add Money to Binance App: A Step-by-Step Guide

What Exactly Is Mining for Bitcoin?

What is Bitcoin Mining?

Bitcoin Mining with GPU in 2017: A Look Back at the Evolution of Cryptocurrency Mining

Binance Smart Wallet Metamask: A Comprehensive Guide to Securely Managing Your Crypto Assets

The Price of Bitcoin at Inception: A Journey Through the Cryptocurrency's Early Days

Is Binance Coinbase: A Comprehensive Comparison

links

- **Maximizing Your Bitcoin Mining Efficiency with a Mining Calculator for Bitcoin

- Should I Buy Bitcoin Cash (BCH)?

- Why Does Bitcoin Price is Falling?

- Baking with Cake Binance USDT: A Sweet Investment in the Crypto World

- FPGA Mining Bitcoin: A Game-Changing Technology

- Baking with Cake Binance USDT: A Sweet Investment in the Crypto World

- ### Exploring the World of Places That Accept Bitcoin Cash

- Buy Bitcoin Locally with Cash: A Guide to Secure and Convenient Transactions

- Bitcoin Mining ASIC 2019: A Year of Innovation and Advancements

- How to Cash Out on Bovada with Bitcoin